How does just one navigate the intricate methods associated with finalizing an SBLC monetization transaction? The method is both of those critical and sensitive, Along with the prospective to significantly influence monetization results.

Along with the growing need for non-traditional funding options, instruments are set to Engage in an ever more necessary part in the finance business.

El almacenamiento o acceso técnico es necesario para la finalidad legítima de almacenar preferencias no solicitadas por el abonado o usuario.

If it’s a cash payment, the funds are transferred to the beneficiary’s selected checking account. If it’s a personal loan, the personal loan arrangement conditions appear into outcome, plus the beneficiary is anticipated to adhere for the agreed-upon repayment plan.

Status and Trustworthiness: Choose your monetization companion correctly. Get the job done with trustworthy monetary establishments or investors to prevent prospective fraud or scams.

One particular common use for devices is to deliver dollars flows for investors. These instruments in many cases are chosen more than unstable investments like stocks because they give a regular supply of money.

Step one in monetizing an SBLC is to possess just one in what is an mt700 hand. The SBLC is typically issued by a bank or money establishment on the ask for in the applicant and is made payable into the beneficiary.

SBLCs are issued by banks and act as a backup payment system, guaranteeing payment in the event that the client is unable to fulfill their payment obligations. When SBLCs are largely employed for trade finance functions, they are also important assets which can be monetized to access income resources.

Due Diligence: The monetization provider conducts a thorough due diligence process to assess the authenticity and validity in the SBLC. This will involve verifying the terms and conditions outlined inside the SBLC.

Choosing a highly regarded Standby Letter of Credit history (SBLC) provider can be a crucial step that requires complete due diligence to ensure the integrity and reliability on the money instrument.

This instrument enables the client and vendor to safe a transaction by utilizing the letter of credit rating sblc the lender being an middleman.

SBLC monetization emerges as a sophisticated technique that allows firms to optimize their capital efficiency by changing these instruments into liquid belongings.

Considering that this arrangement requires credit rating, the financial institution will gather the principal amount of money as well as any interest from the client.

Each and every gain underscores the strategic benefit of leveraging standby letters of credit rating, transforming them into Energetic economic resources.

Mara Wilson Then & Now!

Mara Wilson Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jeremy Miller Then & Now!

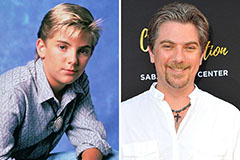

Jeremy Miller Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!